A Place to Plant Roots

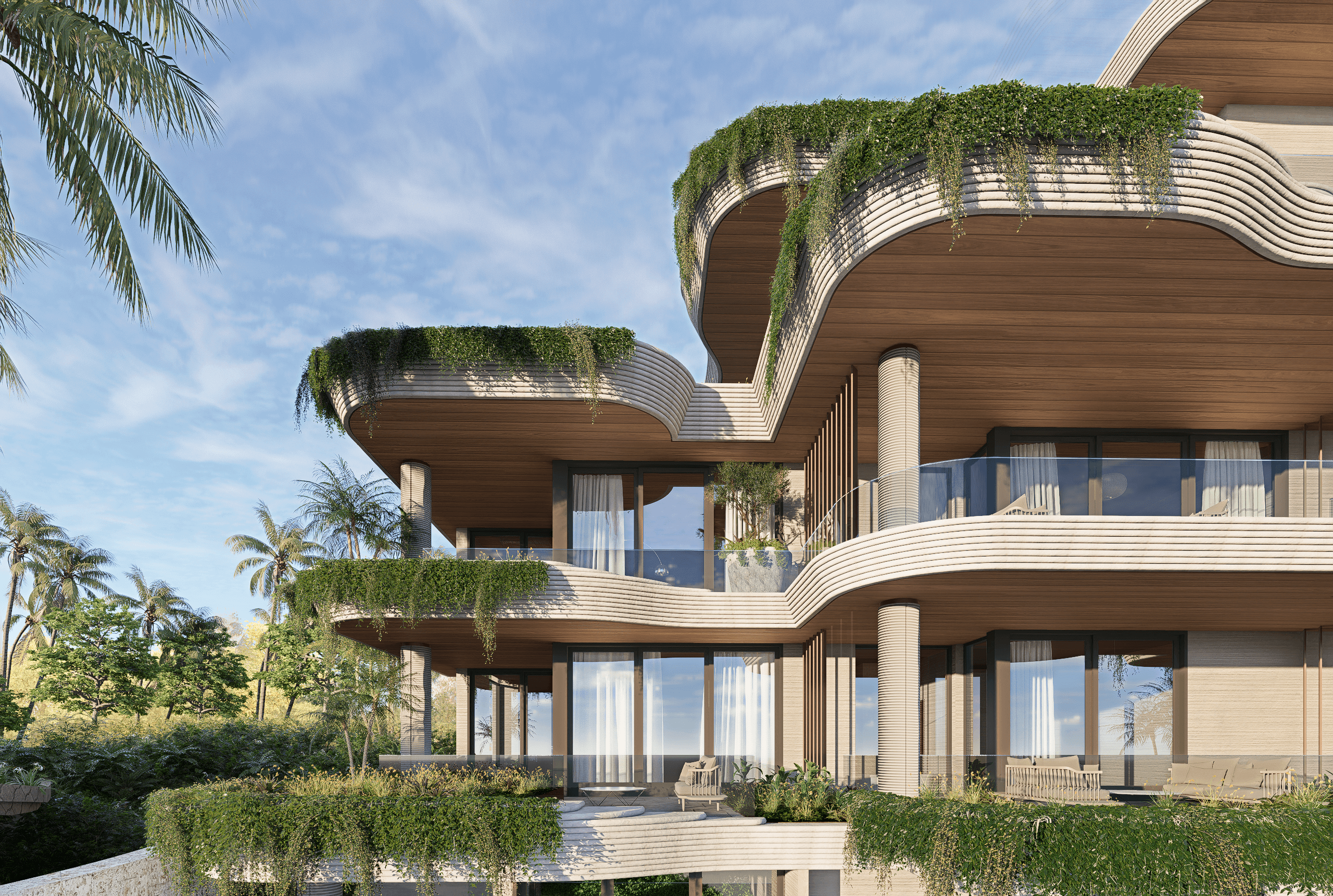

Moncayo is a private residential community on Puerto Rico's eastern seacoast that unites stunning natural beauty and ultra-premium residences. And because of its location, residences may qualify for Act 60 benefits.

Comprehensive Tax Benefits for Individuals and Their Businesses

Puerto Rico’s Act 60 offers significant advantages to individuals and their businesses, making the island an attractive residential haven for those seeking tax efficiency alongside an exceptional lifestyle. By relocating to Puerto Rico, individuals and businesses can unlock a range of tax benefits that are unavailable elsewhere. These incentives are offered to individuals and businesses that demonstrate a long-term commitment to Puerto Rico by fully integrating into the local economy and community.

income tax rate, payable to the government of Puerto Rico

federal income tax rate paid to the United States government

exemption on capital gains accrued after establishing residency

exemption on property taxes

Discover the Advantage of Living at Moncayo

Fill out the form and a member of our team will connect with you directly.

The information provided on this page is for general informational purposes only and does not constitute legal, financial, tax, or investment advice. While we strive for accuracy and reliability, we make no guarantees—express or implied—regarding the completeness or suitability of the content for any specific purpose.

Prospective buyers are strongly encouraged to conduct their own due diligence and consult with qualified legal, financial, and tax professionals before making any decisions. This content is not part of any contractual agreement and should not be interpreted as such. View full disclaimer.